Overview:

To present an overly simplified view, the core framework of our strategy is based on traded volume at price and the subsequent price action thereof. Each of our trade setups are predictive pattern recognition algorithms within this framework. Our algorithms evaluate the current activity in the designated market and execute trades based on determined expectancy. Our systems do not rely on any of the standard array of technical indicators to evaluate and execute trades thus eliminating decisions based on lagging methodologies.

Although our strategy is market independent, dynamically designed and not curve fitted by any means, due to the nature of our framework, we work exclusively with the ZB (30 year US Treasury Bonds) instrument due to the fact that the ZB offers high liquidity, the most relatively stable volatility (i.e. price levels tend to hold relative to all other instruments with relatively steady movements) and the lowest exchange fees per traded contract.

Back Testing:

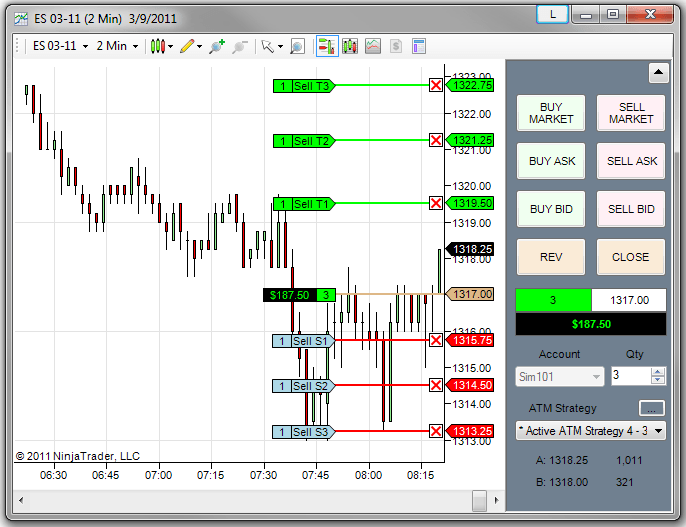

Our algorithms evaluate market conditions and activity intratick, i.e. our strategy evaluates incoming level 1 market data in between ticks to make trading decisions. NinjaTrader 7 does not directly offer the capability to conduct standard strategy backrests with this level of granularity. The workaround is to download Market Replay Data and run our strategies forward on past trading days as if those were live trading days. Although this process takes much longer to complete for tests covering long spans of time, it also provides a more reliable expectancy for how our strategy is likely to perform in the live market. The only exceptions to consider in the live scenario are order routing and broker fills.

Deriving Expectancy:

Our approach is methodical, precise and iterative. The following is a simplified high level overview of the basic performance test cycle.

- Program a trade setup / trade idea based on volume and price action pattern recognition.

- Configure strategy parameters to be tested.

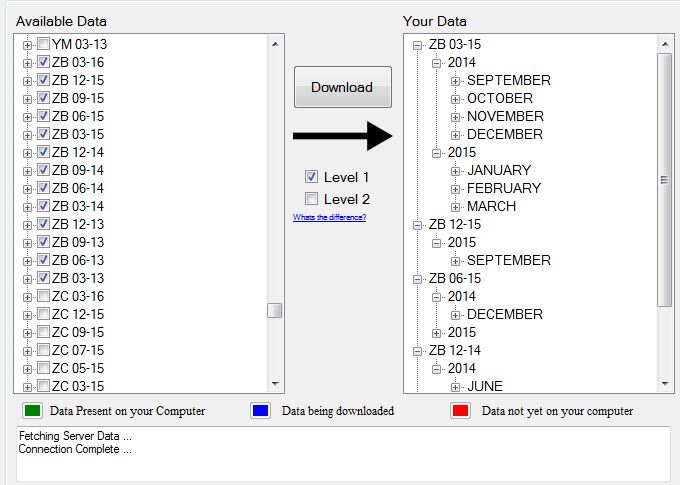

- Download the entire span of market replay data available for the ZB instrument from marketreplaydata.com

- Run market replay forward starting from the first available replay date and record daily performance data.

- Consolidate and analyze daily performance data after 90 trading days to assess viability. If performance data proves promising, continue running tests through the entire span of available data.

Our test data ranges from Jun 2013 through Oct 2015 covering nearly 28 months of trading data. Each of the strategy configurations we test take many thousands to tens of thousands of trades over this period. We eliminate any trade setup and configuration that does not meet our specific performance standards. Once we identify a group of profitable setups we introduce risk management parameters to those setups then retest them over our entire data span to determine if they are still viable. We are not only looking for a system with a positive expectancy, but a system that works alongside your defined risk and draw down whilst building a consistent trading strategy. Our efforts to develop and identify high expectancy, managed risk trade setups and strategy configurations are ongoing. Our product pricing is dependent on the configurations that are offered to our clients.

Performance Expectancy Results

Performance Testing Premise & Constraints

- Performance results must include All In Round Turn Trading Costs/Fees (Commissions + Exchange Fees & Clearing Fees)

- Performance test must be conducted for the entire span of available continuous sequence Market Replay Data going back from the present day(s) during which performance tests are conducted (e.g. for ZB the earliest available data from which there are no significant trading day sequence gaps starts from 7/1/2013 on the ‘ZB 09-13’ contract; data source: marketreplaydata.com).

- Days inside of the trading data span for which data does not exist cannot be tested, but will not be considered to impact overall performance expectancy.

- Trade setup algorithms must not be optimized for specific market conditions. Each trade setup must independently withstand all market conditions included in the test period including all news release impacts that occur during permitted trading times.

- Only money management parameters such as maximum session draw down per strategy instance tested, session profit and session loss limits may be implemented to minimize risk and maximize gain.

- Maximum RISK on any given trade is 1 – 3 ticks. The average target risk on any given trade is 1-2 Ticks. Any trade may only realize loss greater than the set stop loss in the event the market slips and cannot fill orders at the desired stop level. Our tests take this into account naturally as a result of covering such large data span.

- A minimum of 5000 trades will be required over the test data span to accept derived expectancy as reliable.

© 2015 OptimalTraderLLC

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.